cyber hygiene mas

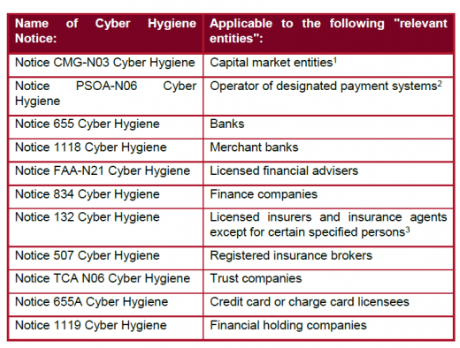

Evaluates external network presence by executing continuous scans of public static IPs for. Notices on Cyber Hygiene View the requirements relating to cyber security for the different types of financial institutions.

Albert Plattner Albertplattner Twitter

Singapore 6 August 2019.

. Technology Monetary Authority of Singapore at the 3rd Cyber Security Advisory Panel Meeting on 30 September 2019. MAS Hygiene Check For Agents and Individuals. It sets out cyber security requirements on securing administrative accounts applying security patching establishing baseline security standards deploying network security.

Iii such persons or class of persons as may. Notice 132 Cyber Hygiene. DPO as a Service.

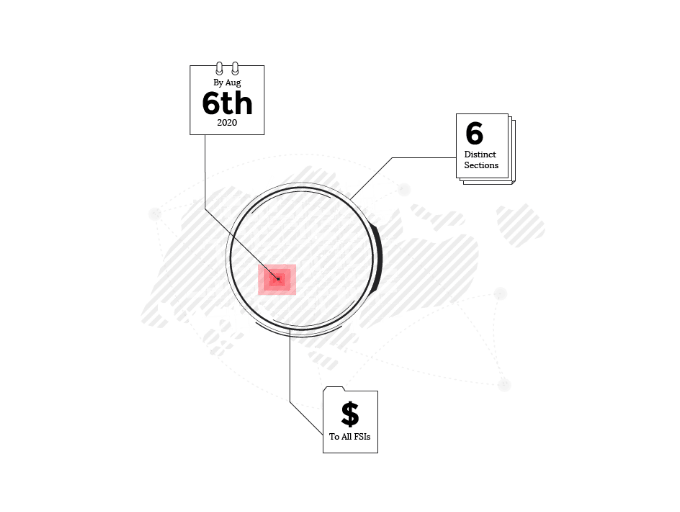

The goal of cyber hygiene is to keep sensitive data secure and protect it from theft or attacks. On 6th August 2019 the Monetary Authority of Singapore MAS released Notice on Cyber Hygiene to raise the cyber security standards and strengthen cyber resilience of the financial sector. Requirements on cyber hygiene for insurers and insurance agents.

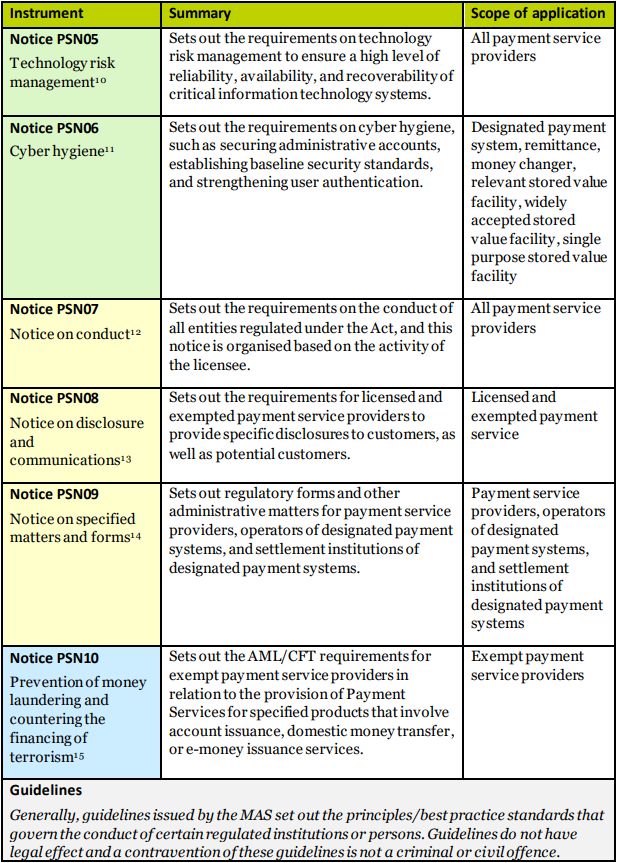

Notice issued under the Payment Services Act 2019 that set out cyber hygiene requirements. The Monetary Authority of Singapore MAS has announced that all financial services and e-payment firms must comply with a new set cyber hygiene rules. Cyber hygiene or cybersecurity hygiene is a set of practices organizations and individuals perform regularly to maintain the health and security of users devices networks and data.

19 section 55 1 This notice applies to all banks in Singapore. Ensure system flaws are fixed. Securities and Futures Act Cap.

On August 6 2019 the Monetary Authority of Singapore issued a set of legally binding requirements to raise the cyber security standards and strengthen cyber resilience of the financial sector. B all insurance agents except for any of the following persons. Notice 655 Cyber Hygiene.

Mr Vincent Loy Assistant Managing Director Technology MAS spoke on steps MAS has taken over. Comply to Monetary Authority of Singapore MAS Cyber Hygiene from 8100 today. Our DPO service is specifically designed for whose SME that require minimal compliance to PDPA but are unable to hire a DPO themselves either due to business and.

Please set the amount of your devices which should be checked during the MAS Hygiene assessment. The Notice on Cyber Hygiene makes key elements in the MAS Technology Risk Management TRM Guidelines compulsory and firms have until 6 August 2020 to implement them. The Notice on Cyber Hygiene sets out the measures that financial institutions must take to mitigate the growing risk of cyber threats.

Data Protection Officer Service as a Service. Comply to Monetary Authority of Singapore MAS Cyber Hygiene starting from 8100. 2 The revised Guidelines focus on addressing technology and cyber risks in an environment of growing use by financial institutions FIs of.

The Monetary Authority of Singapore has issued baseline requirements on cyber hygiene as well as easing the approval process for its fintech regulatory sandbox. 289 section 45 1 section 46ZK 1 section 81R 1 section 81SV 1 section 81ZL 1 section 101 1 section 123ZZB 1 and section 293 1. Research suggest that less than 30 of organisations.

It sets out cyber security requirements on securing administrative accounts applying security patching establishing baseline security standards deploying network security devices implementing anti-malware measures and. The notice on cyber hygiene sets out the measure financial. The concept works similarly to personal hygiene.

The Monetary Authority of Singapore MAS today issued a set of legally binding requirements to raise the cyber security standards and strengthen cyber resilience of the financial sector. A relevant entity must ensure that every administrative account in respect of any operating system database application security appliance or. Cyber Hygiene Practices 41 Administrative Accounts.

The Monetary Authority of Singapore MAS today issued revised Technology Risk Management Guidelines 5787 KB Guidelines to keep pace with emerging technologies and shifts in the cyber threat landscape. Applying security patching is one of the key practices and pillars laid out in the MAS guidelines. The cyber hygiene guidelines published by the Monetary Authority of Singapore sets out cyber security guidelines and practices that organisations must put in place to manage cyber threats.

The Notice on Cyber Hygiene sets out the following cyber security requirements that financial institutions must comply with. The MAS identified six elements that all financial firms must follow to reduce the risk of cyber threats. This Notice on Cyber Hygiene took a number of key elements that already existed in the MAS Technology Risk Management TRM Guidelines and put.

What the MAS Cyber Hygiene Circular Means for Singapore-Based Financial Firms. Ii a person exempted from holding a financial advisers licence under section 23 1 f of the Financial Advisers Act Cap. On 6 August 2019 the Monetary Authority of Singapore MAS issued a set of legally binding requirements to raise the cyber security standards and strengthen cyber resilience of the financial sector.

In the Monetary Authority of Singapore MASs most recent revision to the Technology Risk Management Guidelines in 2021 the updated guidelines focus on addressing technology and cyber risks by financial institutions FIs specifically in cloud technologies application programming interfaces and rapid software development. Requirements on cyber hygiene for capital market entities. MAS Cyber Hygiene For Agents and Individuals.

Ensure robust security for IT systems. Notice CMG-N03 Cyber Hygiene. Requirements on cyber hygiene for banks.

This notice applies to the following capital. On 6th August 2019 The Monetary Authority of Singapore MAS issued a set of legally binding requirements to raise the cybersecurity standards and strengthen cyber resilience of the financial sector. The Cybersecurity and Infrastructure Security Agency CISA offers several scanning and testing services to help organizations reduce their exposure to threats by taking a proactive approach to mitigating attack vectors.

Notice PSN06 Cyber Hygiene. Proven and most cost-effective package in the market. Microsoft Word - 03 Notice on Cyber Hygiene MAS Notice 655 Banks - Banking Act 6 Augdocx Author.

MAS Cyber Hygiene Compliance Package. The Notice on Cyber Hygiene sets out the measures that financial institutions must take to mitigate the growing risk of cyber.

Webinar Complying With Mas Cyber Hygiene Guidelines Tenable

Mas Cyber Hygiene Compliance With Horangi

Singapore Monetary Authority Of Singapore Issues New Rules To Strengthen Cyber Resilience Of Financial Industry

Singapore Monetary Authority Of Singapore Issues New Rules To Strengthen Cyber Resilience Of Financial Industry Lexology

Technology Risk Management Guidelines Notice On Cyber Hygiene For Singapore S Ibm I Community Jouletech

Mas Cyber Hygiene Compliance With Horangi

Mas Cyber Hygiene Compliance With Horangi

Mas Cyber Hygiene Compliance With Horangi

Cyber Hygiene Rules Singapore To Kick In August 2020 Mas

Mas Cyber Hygiene Compliance With Horangi

Off To The Races The Commencement Of The Payment Services Act Financial Services Singapore

Complying With Monetary Authority Of Singapore Mas Cyber Hygiene Guidelines Whitepaper Tenable

Cyber Hygiene And Mas Notice 655 Aws Security Blog

Cyber Hygiene Assessment Deloitte Singapore

Meeting Mas Cyber Hygiene Notice Requirements On Aws Youtube

Comments

Post a Comment